Top Five Carbon Footprint Questions Asked by Private Market Investors, Answered

A carbon footprint is a tool for measuring the greenhouse gas (GHG) emissions for various entities including organizations, individuals, or processes. It is a picture of how many tons of CO2eq any given entity emits when in operation.

A carbon footprint is a tool for measuring the greenhouse gas (GHG) emissions for various entities including organizations, individuals, or processes. It is a picture of how many tons of CO2eq any given entity emits when in operation.

It allows firms to identify:

- Processes that contribute to carbon emissions

- The entity that is responsible or dependent

- Which entities emit the most GHG

- An action plan to reduce emissions, once identified

Measuring GHG emissions for privates markets investors is often more challenging than corporations think because the assets within their funds can be varied and exist within diverse industries. In this article, we’ll be breaking down carbon emissions and evaluating them from the lens of a privates market investor to answer the following questions:

- What is not a carbon footprint?

- What does Scope 1, 2, and 3 mean?

- How is GHG emissions data calculated to become decision-useful?

- What are the main steps for privates markets investors to complete a carbon footprint analysis?

- How can privates market investors use a carbon footprint to implement a climate strategy?

- What does a carbon footprint look like for privates market investors?

What is not a carbon footprint?

Carbon footprint should not be confused with:

- An analysis of the different impacts of a company on water, soil, etc. This is called a life cycle analysis.

- A direct identification of a company’s good practices. This is either a comparison of two carbon footprints or a calculation of the reduced emissions of a product/service relative to the emissions of a reference product/service.

- An action plan to reduce its emissions. This is to be carried out after the carbon footprint analysis is complete.

What does Scope 1, 2, and 3 mean?

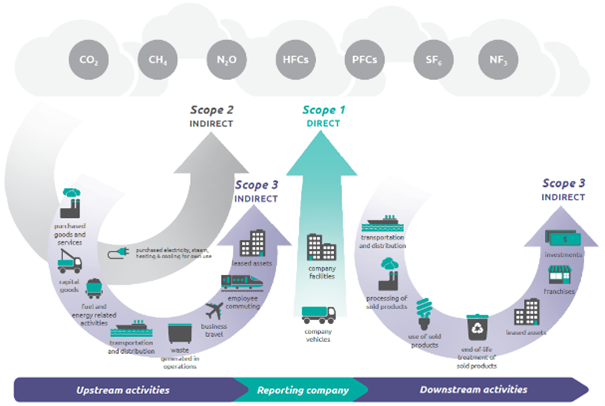

The measurement of GHG emissions gets more complex as you move up the scopes.

Scope 1 – Direct emissions (e.g. How much GHG does this factory create in a year? How many trucks does the company have on the road?)

Scope 2 – Indirect activities (e.g. How much electricity does it take to keep the lights on? How much fossil fuel is used to air condition a plant in Texas in August or heat a plant in Vermont in January?)

Scope 3 – Indirect activities upstream or downstream (e.g. What happens to all the paper cups my asset produced last year? What is the GHG emission for flying my sales team to an offsite?)

It is important to consider all upstream and downstream activity for which the entity is responsible, but also all the processes for which the entity is dependent, (e.g. manufacturing of products purchased by the entity, electricity consumption related to the use of products sold by the entity or their end-of-life). Consider the graphic below from Greenhouse Gas Protocol.

How is GHG emissions data calculated to become decision-useful? (THE MATH)

To move from activity data (energy consumption, quantity of purchases, etc.) to GHG emissions, you must multiply the activity data by what are called emission factors. Emissions Factors, whose unit is kgCO2eq/unit of activity (e.g. kgCO2eq/kWh, kgCO2eq/kg, etc), can be found in public or paid databases. They are calculated by scientific groups or are the result of life cycle analyses of products carried out by companies, which are gradually added to these databases.

It is important to keep in mind that the emission calculations of a carbon footprint remain estimates, because it is rarely possible to find the exact emission factor of a product (up to 80% for emission factors are related to spending on products or services), therefore it is considered a general emission factor of a product category.

Emission factors are used to convert activity data into a single unit and the impact of all these greenhouse gases are converted to the impact of CO2, using the carbon footprint unit kgCO2eq. This means, for example, that for methane, which has the same climate impact as 25kg of CO2, one kilogram of methane emitted into the atmosphere is equal to 25 kilograms of CO2eq.

What are the main steps for private markets investors to complete a carbon footprint analysis?

- Definition of the parameters

The parameter definition phase should not be skipped over or undervalued. A carbon footprint only makes sense if the parameters are clearly defined. It creates the map of what will be included in the calculation and allows analysts to accurately trace the activities responsible for GHG emissions.

- Data collection

Once the parameters are defined, the relevant activity data points to measure them are defined (e.g. quantity of products purchased, quantity of fuel consumed, etc.) and which are available by the company (e.g. if the company does not have access to the quantities of fuel consumed, then it can collect the data distances travelled).

Because private markets investors work with various departments within a single company or asset, and then across multiple companies or assets, it is important for the investor to group data into one place with a rolled-up view of the whole fund or portfolio.

- Calculations and results

Once the data is collected, analysts will then identify the emission factors for each data point and multiply them by the activity data to come up with the CO2eq. Finally, the results are added together into a consolidated carbon footprint.

How can private markets investors use a carbon footprint to implement a climate strategy?

Once the carbon foot printing exercise is complete, firms can begin to use the data to drive their decisions. It is not enough to simply see the data without putting in place a strategy to reduce emissions.

But don’t be discouraged! A climate strategy is not an overnight process. This strategy can include a climate trajectory, which can be represented as a percentage reduction in GHG emissions that is set for 5 or 10 years, for example. This percentage can be defined using recognized methodologies such as the Science-Based Targets initiative, which allows to set a climate trajectory in line with the Paris Agreement.

What does a carbon footprint look like for private markets investors?

Let’s look at an example of a management company.

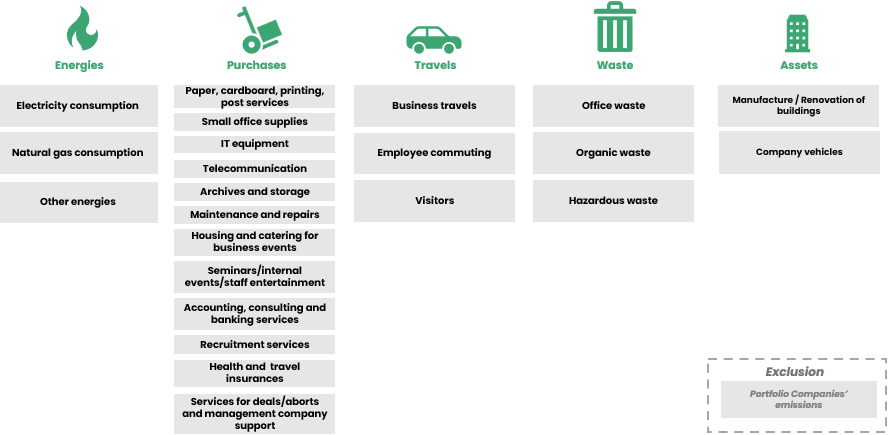

The main processes of a management company are related to its energy consumption, its purchases of services, and to expenses related to the management of the various funds (lawyer’s fees, consulting firm fees, etc.), the business travel of its employees, its rental of buildings and company vehicles, and its production of waste.

The carbon footprint of a management company must also include the carbon footprint of its investments, but it is common for investments to be excluded initially, and for their respective carbon footprints to be done in parallel before being included in the management company’s carbon footprint.

Although the mapping of emissions depends on each company, the flow map might look like this:

Mapping of the emission items of a Management Company

When mapping, it is important to clearly specify the parameters considered and the exclusions that have been made, due to a lack of available data.

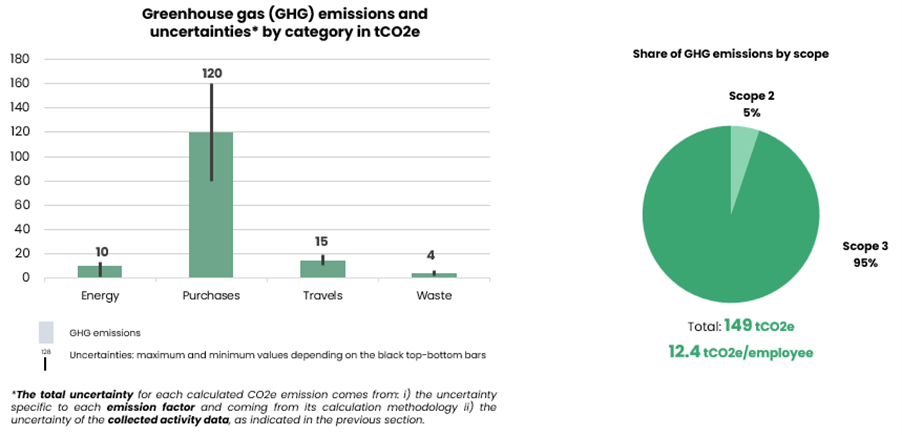

Once the data points have been collected and the calculations made, here is what a management company’s carbon footprint might look like:

Carbon Footprint of a Management Company

Like almost all services companies, most of emissions are part of Scope 3, and are mainly linked to the purchase of services. It is important in this case to have specified in the mapping of the emission items that emissions linked to portfolio companies were excluded, because if they had been included, they would have represented the vast majority of the management company’s emissions.