The EU Green Taxonomy: Recent updates and insights from 2022 reportings

As part of the European Sustainable Finance Package, a set of regulations aiming at redirecting investments towards more sustainable options, the European Taxonomy plays a crucial role. The European Green Taxonomy is a common classification system that identifies economic activities considered as sustainable by contributing to one environmental objective among the 6 objectives[1] defined by the EU.

On 27 June 2023, the European Commission adopted a package of delegated acts. It includes 1) amendments to the first climate delegated acts and 2) defines the activities eligible under the last 4 objectives of the Taxonomy and the criteria for alignment.

This article highlights key insights from the latest year of Taxonomy reporting and explores the recent publications of the European Commission. It also lists the available tools to help you in calculating your share of alignment with the EU Green Taxonomy.

2022 Taxonomy Disclosures: Reporting trends

Observations from recent Taxonomy corporate disclosures for the financial year 2022 reveal that 63% (Commission staff working document, June 2023, SWD(2023) 209 final) of STOXX Europe 600 companies have already disclosed their eligibility and alignment with the Taxonomy on the two first objectives. On average, the taxonomy alignment of these companies is around 17% for revenue, 23% for CapEx, and 24% for OpEx (Commission staff working document, June 2023, SWD(2023) 209 final).

These figures are likely to increase in the coming years, with the company’s growing familiarity with this regulation and the addition of sectors in the taxonomy (e.g., agriculture, textile, etc.). Furthermore, the alignment will be gradually calculated across all taxonomy objectives (i.e climate, biodiversity, pollution prevention, water and circular economy), increasing the possibility for a company to be aligned with the Taxonomy.

A significant number of companies are reporting considerably higher aligned CapEx figures compared to their aligned revenue figures, especially in high-emitting sectors, thanks to investment in activities considered sustainable by the European taxonomy. The utility sector leads in average alignment for both CapEx (70%) and revenue (40%), followed closely by the real estate sector (25% aligned CapEx, 25% aligned revenue) (Commission staff working document, June 2023, SWD(2023) 209 final). This indicates the potential for companies in sectors that need to decarbonise the most to report a portion of alignment with the European taxonomy.

Updates by the European Commission

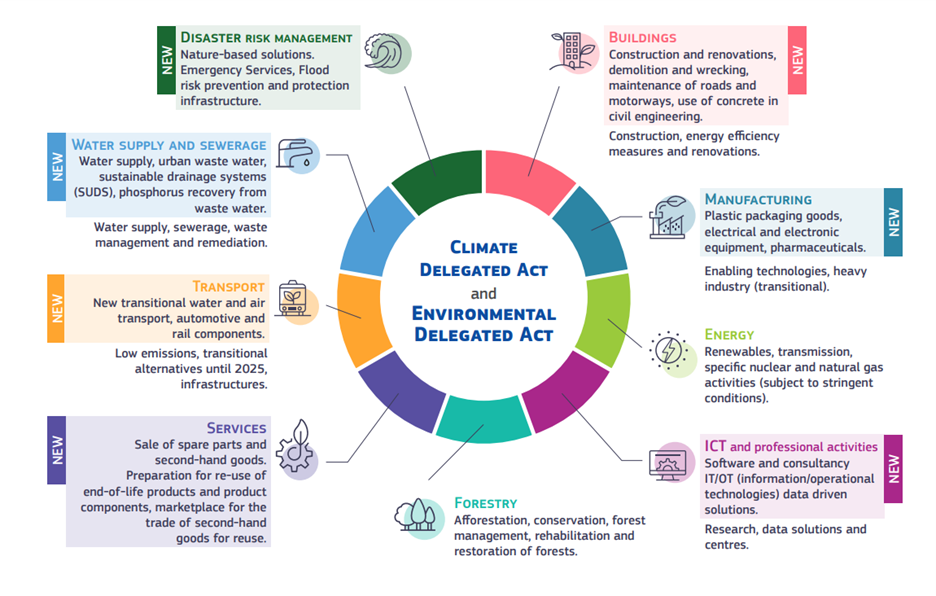

The Taxonomy Climate Delegated Act (for climate mitigation and climate adaptation objectives) is already up and running and covers a total of 107 economic activities spanning over 13 economic sectors.

In June 2023, the European Commission introduced a series of amendments to clarify technical criteria and expand the list of economic activities that significantly contribute to climate change mitigation and adaptation objectives.

These additions mainly cover the transportation sector, including the integration of the aviation industry. Moreover, eligible activities of the final four objectives of the European taxonomy have also been revealed. These Delegated Acts add more than 35 activities spanning over 8 sectors.

Summary of the sectors and activities covered by the EU Green Taxonomy among the 6 objectives:

European Union, 2023

https://finance.ec.europa.eu/system/files/2023-06/230613-sustainable-finance-factsheet_en_0.pdf

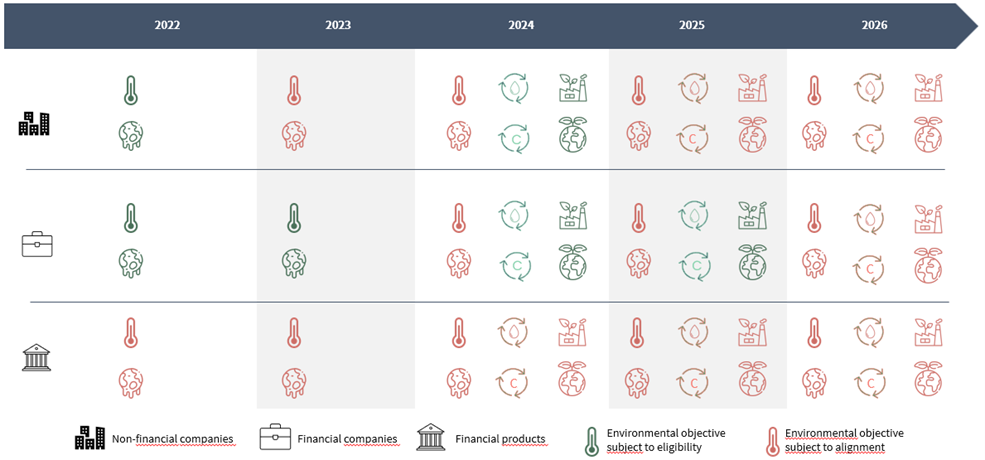

Reporting obligation and timeline

The obligation to report on the 6 environmental objectives is progressive and differs according to undertakings:

Evolutions to be expected from the European Commission

The European Commission aims to enhance the usability of the taxonomy criteria and disclosures, ensuring consistency within the sustainable finance framework and other regulations (particularly with the SFDR[2] and the CSRD[3]).

The Commission has therefore announced a comprehensive assessment of the implementation of the SFDR framework. The exercise will mainly focus on assessing the shortcomings of the SFDR to improve legal certainty, enhance its usability and clarify any points of contradiction with the taxonomy.

The Commission plans to adopt another guidance document by the end of this year, that will focus on taxonomy alignment reporting obligations for financial undertakings, which will be required to report their green assets ratio (GAR) and other KPIs as of 1 January 2024.

Moreover, an assessment will be conducted to determine the inclusion of entities outside the scope of taxonomy reporting in financial institutions’ key performance indicators, including small and medium-sized enterprises (SMEs), which are not themselves covered by this reporting obligation.

Finally, we can expect regular updates to the Climate and Environmental Delegated Acts to address usability issues, market developments, and technological progress over the years. A comprehensive review of controversial sectors will occur every three years, starting with gas and nuclear sectors in 2024.

Tools for calculating alignment with the EU Green Taxonomy

To facilitate the implementation of the taxonomy, the European Commission has recently launched online tools and guides accessible through the EU Taxonomy Navigator website. These tools include:

- FAQs repository: Users can search for specific questions that are of interest to them and filter the questions by organisation type and FAQ document.

- EU Taxonomy Compass: Online tool that enables users to search for economic activities covered in the Climate Delegated Act and directly access their respective technical screening criteria. The Taxonomy Compass’s content can be downloaded in Excel and JSON format.

- EU Taxonomy Calculator: Interactive tool to show non-financial undertakings in a step-by step guide how to determine their taxonomy eligibility and alignment ratios. The tool guides users through seven main step to calculate their turnover, CapEx and OpEx KPIs and automatically fills in the respective reporting templates to the Taxonomy Disclosures Delegated Act. To date, only the first objective related to climate change mitigation 1 is available on this tool.

- User guide: Step-by step guide to help non-financial and financial undertakings assess their taxonomy eligibility and alignment.

While many developments and clarifications are still needed (link with the SFDR, addition of activities etc.), the latest elements published by the European Commission represent a major step forward in the development and usability of the Taxonomy. All companies now have the necessary elements for its implementation. Nevertheless, the Taxonomy remains complex, and anticipating its criteria and data collection procedures remains crucial. Reporting 21 can help you to understand and comply with the Taxonomy.

Contact us to learn more about our sustainability advisory and ESG reporting software tool.

Sources:

- https://ec.europa.eu/sustainable-finance-taxonomy/

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52023SC0209

- https://finance.ec.europa.eu/system/files/2023-06/230613-sustainable-finance-factsheet_en_0.pdf

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52023XC0616(01)

- https://finance.ec.europa.eu/system/files/2023-06/taxonomy-regulation-delegated-act-2022-climate-annex-1_en_2.pdf

- https://finance.ec.europa.eu/system/files/2023-06/taxonomy-regulation-delegated-act-2022-climate-annex-2_en_1.pdf

[1] Climate change adaptation; Climate change mitigation; Sustainable use and protection of water and marine resources; Transition to a circular economy; Pollution prevention and control; Protection and restoration of biodiversity and ecosystems

[2] Sustainable Finance Disclosure Regulation

[3] Corporate Sustainability Reporting Directive. Find more: https://www.reporting21.com/resources/the-corporate-sustainability-reporting-directive-csrd/